Ceocolumn We Talk Money: Smart Ways To Handle Business Funds

Talking about money can feel a bit like looking at a very detailed map, full of twists and turns, especially when it comes to running a business. It's a topic that, you know, touches every part of what you do, from paying the bills to planning for what's next. For anyone leading a company, understanding how money moves is just so important, perhaps the most important thing.

This space, our ceocolumn we talk money, aims to make those money talks a little easier to have, actually. We want to share ideas that help business leaders, and anyone interested in finances, feel more confident about their money choices. It's about finding clear paths through what can seem like a dense forest, more or less.

We'll look at how to manage funds well, how to make smart spending choices, and even how to grow what you have. This article will offer some thoughts on handling your company's cash, just like you might find different kinds of helpful information in 'My text' about managing digital tools or understanding various business models. It's all about making things work better, anyway.

Table of Contents

- Understanding Your Business Money

- Making Money Choices

- Growing Your Company's Funds

- Common Money Mistakes to Avoid

- Looking Ahead: Future Money Steps

- Frequently Asked Questions About Business Money

Understanding Your Business Money

For any business, big or small, truly getting a handle on your money is the first step, you know. It’s not just about how much comes in, but also about how much goes out, and when. This picture helps you see the true health of your company, in a way.

Think of it like keeping track of everything in your home, from what you buy at the store to the bills you pay. If you don't know these things, it's hard to make good plans for later, so.

Knowing Where Your Money Goes

One of the first things a business leader should know is where every bit of money is headed, actually. This means tracking all expenses, big and small. It helps you see if you are spending too much in one area, or if you could use funds better somewhere else, more or less.

For instance, do you spend a lot on office supplies, or on certain services? Knowing this helps you make smarter choices, you see. It's like checking your car's fuel gauge often, to know how far you can go, or how much more fuel you might need, apparently.

Keeping a clear record of all transactions is a good habit, too it's almost. This record helps you review your spending patterns over time. It shows you where your money is flowing, and if those flows are helping your business grow, or just keeping things going, just a little.

You might find that some costs are not really helping your business move forward, in some respects. These are the areas where you could perhaps cut back. It’s about being thoughtful with every dollar, making sure it works hard for you, as a matter of fact.

Making Sense of the Numbers

Looking at your financial numbers can seem a bit much at first, but it gets easier, really. These numbers tell a story about your business. They show you if you are making enough money to cover your costs, and if you have some left over, you know.

You want to look at things like how much money comes in from sales, and how much goes out for things like rent or salaries. These are basic facts that give you a good idea of your financial standing, so. It’s like checking your health numbers to see if you are well, or if you need to make some changes, perhaps.

Understanding these numbers also helps you spot problems early, too. If costs are rising faster than your sales, that’s a sign to look closer, perhaps. It lets you take action before things get too out of hand, basically.

Many tools exist to help with this, by the way. Simple spreadsheets or even special software can make tracking and understanding your money much simpler. The goal is to have a clear picture, not a fuzzy one, you know.

Making Money Choices

Once you understand your money, the next part is making good choices about it, actually. This means deciding how to spend what you have, and how to put some aside for later. Every choice you make with your business funds has an effect, more or less.

It's like deciding what to do with a small amount of water in a desert. You want to use it where it will do the most good, and save some for when you really need it, right?

Spending with a Plan

Spending money in your business should always be part of a plan, really. It’s not just about buying things as you need them. It's about thinking how each purchase helps your business reach its goals, you see. Every dollar should have a job, in a way.

For example, investing in new equipment might cost money now, but it could help you make more products or provide better services later. That's a planned spend, you know. It's about seeing the bigger picture, not just the immediate cost, apparently.

Sometimes, a smaller cost can also have a big effect, too. Training your team, for instance, might not seem like a direct money-maker, but it can make your staff better at their jobs, which helps the business grow, so. It’s about smart allocation, just a little.

Always ask yourself: "How will this purchase help my business succeed?" If you can't answer that clearly, it might be a cost you can skip for now, perhaps. Being thoughtful with spending helps your money go further, as a matter of fact.

Putting Money Aside

Saving money for your business is just as important as saving money for yourself, actually. This money can be for unexpected problems, like a sudden repair, or for future plans, like opening a new location, more or less.

Having a fund for emergencies gives you peace of mind, you know. It means you won't be caught off guard if something goes wrong. It's like having a spare tire in your car, for when you need it, perhaps.

Setting aside money for growth is also a smart move, you see. This could be for new products, new services, or even expanding your team. These are investments in your company's future, so. It’s about building a stronger base for what’s to come, basically.

Even a small amount put aside regularly can add up over time, by the way. The key is to be consistent. Make saving a regular part of your money habits, just like you would pay a bill, you know.

Growing Your Company's Funds

Once you have a good handle on your current money and how to manage it, the next step is thinking about how to make it grow, really. This means finding ways to bring in more money and making the money you have work harder for you, you know.

It's like planting a small seed and watching it become a big tree. It takes care and the right conditions, but the rewards can be great, perhaps.

Finding New Ways to Bring in Money

To grow your funds, you might need to think about new ways your business can earn money, actually. This could mean offering new products or services, or reaching out to new types of customers. It’s about expanding your reach, more or less.

Consider what your current customers really need, you see. Can you offer something extra that they would pay for? Or can you find a new group of people who would like what you already offer, so?

Looking at what other businesses in your area are doing can also give you ideas, too. What are they doing well? What are they missing? These observations can help you find new opportunities, just a little.

Remember that trying new things can take time and effort, as a matter of fact. Not every new idea will work out, but some of them just might open up big new paths for your business to earn, you know.

Thinking About the Future

Growing your company's money also means looking ahead, you know. This involves making plans for how your money will be used in the months and years to come. It’s about setting goals and working towards them, perhaps.

For instance, if you want to buy a new building in five years, you need to start saving and planning for that now, you see. This kind of long-term thinking helps you make steady progress, so. It’s like planning a long trip; you need to know your destination to pack the right things, basically.

This might also involve looking at where you could put some of your money to work, by the way. Maybe a certain kind of investment could help your funds grow over time. It's about making smart choices that align with your future goals, you know.

Staying informed about what is happening in the wider economy can also help, too. Things like interest rates or new market trends can affect your plans. Knowing about these helps you adjust your steps, just a little. For more insights on financial trends, you could look at reports from reputable financial news sources, for instance, like those found on Reuters Finance.

Common Money Mistakes to Avoid

Even with good intentions, it's easy to make a few missteps when it comes to business money, actually. Being aware of these common pitfalls can help you steer clear of them, you know. It’s about learning from what others have done, more or less.

Just like you might learn from different pieces of advice, as seen in the varied content of 'My text', understanding common errors can save you a lot of trouble later, perhaps.

Not Watching Your Cash Closely

One common mistake is not keeping a close eye on your cash flow, you see. This means how much money is coming in versus how much is going out at any given time. If more is going out than coming in, you could run into trouble, so.

It’s not just about making a profit on paper. You need to have actual money available to pay your bills and keep things running, basically. A business can be profitable but still run out of cash if it doesn't manage its flow well, you know.

Regularly checking your bank accounts and your cash flow reports is very important, by the way. This helps you spot any problems early. It’s like checking your car's oil level often, to make sure it doesn’t run dry, you know.

If you see a dip, you can then take steps to fix it, like chasing up payments from customers or holding off on some purchases, perhaps. Being proactive with your cash flow keeps your business stable, just a little.

Ignoring the Small Costs

Another mistake is overlooking the many small costs that add up, actually. Individually, they might not seem like much. But together, these little expenses can take a big bite out of your money, more or less.

Think about things like subscription services you don't use, or small fees here and there, you see. These can quietly drain your funds over time. It's like having a leaky faucet; a drip here and there doesn't seem like much, but it wastes a lot of water eventually, so.

Reviewing all your expenses, even the tiny ones, can reveal areas where you can save, perhaps. You might find you are paying for things you no longer need, or that you could get a better deal somewhere else, basically.

Making a habit of reviewing these small costs regularly can free up money for more important things, by the way. It’s about being smart with every bit of your budget, you know.

Looking Ahead: Future Money Steps

As we think about ceocolumn we talk money, it's clear that handling business funds is a journey, not a single event, you know. It requires ongoing attention and a willingness to learn and adapt, perhaps. The world of business is always changing, and so too should your approach to money.

Staying informed about what's happening in the economy is a good step, you see. Things like inflation, which affects how much your money can buy, or changes in interest rates, which affect borrowing, are good to know about, so. These outside forces can impact your business, and being aware helps you plan.

Also, don't be afraid to ask for help, by the way. Sometimes, talking to a financial expert or a business advisor can give you new ideas or help you solve tricky money problems, you know. They can offer a fresh set of eyes on your numbers and plans, just a little.

Think about setting up regular check-ins for your business finances, actually. Maybe once a month, or every quarter, sit down and look closely at your money. This habit helps you stay on top of things and make timely adjustments, more or less.

Finally, remember that good money management is about making choices that support your business's long-term health and growth, you see. It’s about building something strong and lasting, for instance. You can learn more about financial planning on our site, and also find useful information on business growth strategies.

Frequently Asked Questions About Business Money

Here are some common questions people ask about managing money in a business setting, actually.

How do I make my business financially stable?

To make your business financially stable, you really need to keep a close eye on your cash flow, you know. This means making sure more money comes in than goes out consistently. It also helps to have a good emergency fund put aside, perhaps, for unexpected things that might come up.

What are common money mistakes for business leaders?

Some common money mistakes for business leaders include not tracking expenses carefully, so, and not having a clear budget. Also, ignoring small costs that add up over time can be a problem, by the way. Not planning for future growth or unexpected events is another area where leaders sometimes stumble, you know.

How can I grow my company's wealth?

To grow your company's wealth, you should look for new ways to bring in money, actually, like offering new products or services. It's also smart to reinvest some of your profits back into the business, perhaps in areas that will help you earn more later. Thinking long-term about your money choices is key, you know.

WE-Talk-Money Logo - Robert Gignac

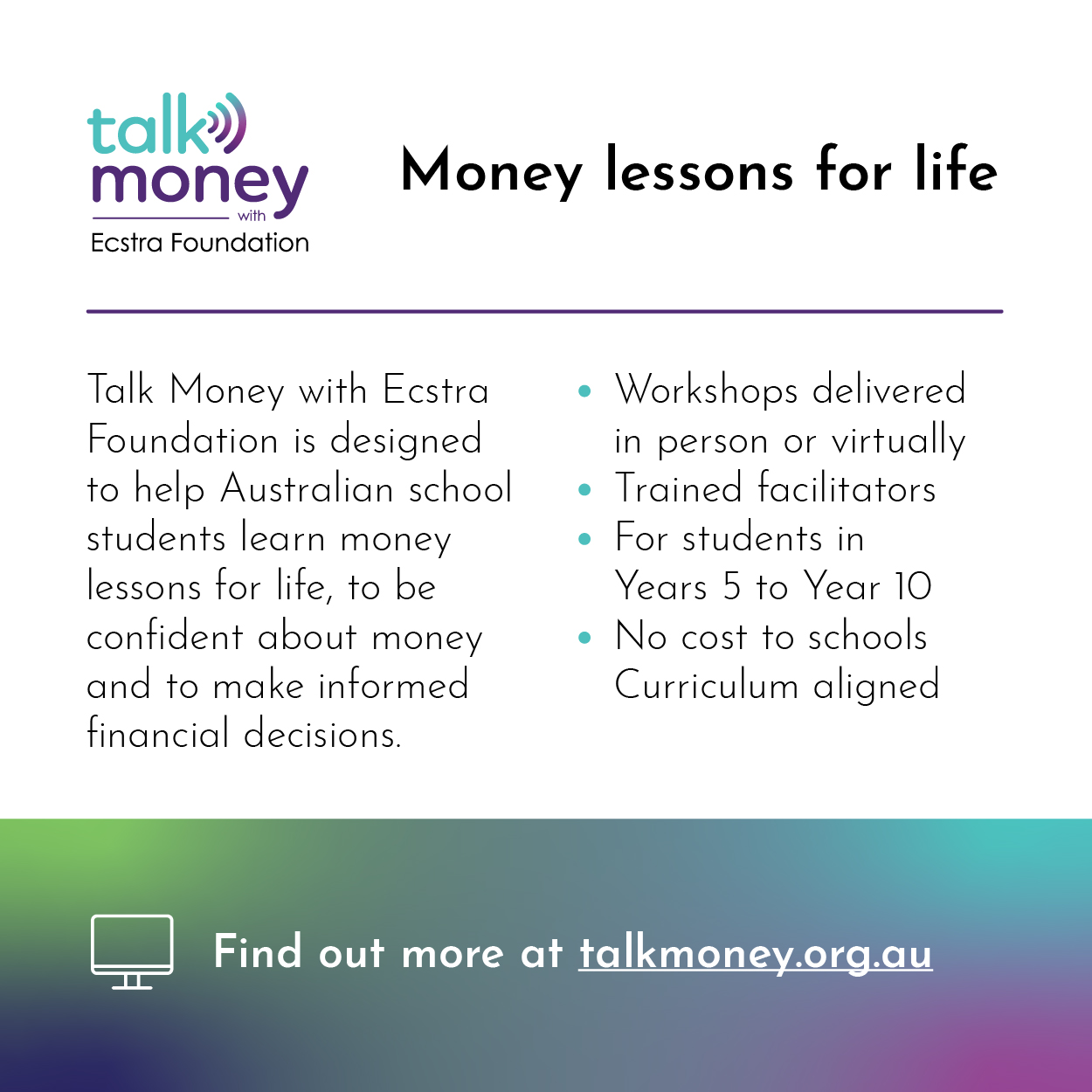

Community - Talk Money with Ecstra Foundation

Community - Talk Money with Ecstra Foundation